EXPERT FINANCIAL MODELling & ANALYSIS

Strategic financial consulting for mining, resource & energy projects

We provide asset owners, advisors, and investors with on-demand financial consulting services helping them understand, manage, and optimise their business. Through custom financial models and strategic analysis, we help our clients make informed decisions that drive sustainable growth.

ABOUT US

We build, manage and maintain custom financial models, giving owners, advisors, and investors the clarity to make decisions with confidence.

Chethan Nooji & Byron Benvie

Directors

An Experienced Team

With over 40 years in the industry and having worked on a large range of projects and commodities around the globe, we bring a wealth of experience to our clients.

Widely accepted

Our models have been reviewed and accepted by domestic and international banks, ECA’s and other investors.

Development & Funding Experts

Having worked on all sides of the funding and development process our clients rely on our expertise to support and guide them through critical investment decision.

In-house & On-demand

Our Directors work with you and your team to provide a specialised, flexible and cost-efficient corporate finance function.

OUR SERVICES

Guiding critical decision-making at every stage of the development cycle

We assist our clients in the mining, metals and energy industries to accurately identify and effectively pursue investment opportunities with robust economics and the highest degree of technical integrity.

Conceptual Studies

- Order of magnitude estimates

- Preliminary economics analysis

- Scenario analysis and development scenarios

Engineering Studies

- Cashflows and valuation

- Custom project and investment dashboards

- Optimisation opportunities

- Development scenarios & funding implications

- Commercial analysis incl. offtake, pricing, trade-offs

Funding

- Financing strategy and capital structure

- Evaluate & compare financing proposals

- Funding process support: lenders model, due diligence, negotiation, execution

Construction

- Cashflows and valuation

- Custom project and investment dashboards

- Optimisation opportunities

- Development scenarios & funding implications

- Commercial analysis incl. offtake, pricing, trade-offs

Operation

- Business planning tools: Budgeting and forecasting

- Strategic options & Life-Of-Mine (LOM) analysis

- Performance tracking and reporting

- Capital budgeting

- Business cases and investment papers

- Refinancing analysis

- Corporate transaction analysis (Sale, mergers and acquisitions processes)

CASE STUDY

Prospect Resources

- (ASX: PSC)

- Zimbabwe, Africa

- Mining | Lithium

- PSC is an Australian-based exploration and development company focussed on opportunities in battery and electrification metals across sub-Saharan Africa. Infinity worked with PSC to develop a Feasibility model for their Arcadia Lithium project in Zimbabwe which was used the optimise the economic outcomes of the project. This model was key to the negotiation and subsequently sale of the asset to Zhejiang Huayou Cobalt in April 2022 for US$378 million in cash. Infinity continues to work with PSC on other opportunities within its portfolio.

PSC is an Australian-based exploration and development company focussed on opportunities in battery and electrification metals across sub-Saharan Africa.

Infinity worked with PSC to develop a Feasibility model for their Arcadia Lithium project in Zimbabwe which was used the optimise the economic outcomes of the project. This model was key to the negotiation and subsequently sale of the asset to Zhejiang Huayou Cobalt in April 2022 for US$378 million in cash.

Infinity continues to work with PSC on other opportunities within its portfolio.

CASE STUDY

Boss Energy

- (ASX: BOE)

- South Australia, Australia

- Mining | Uranium

- BOE acquired the Honeymoon Uranium Project in South Australia in 2015, originally launched as an in-situ recovery uranium mine in 2011. Since then, Boss Energy has utilized the existing high-quality infrastructure on-site and undertaken construction and development work, with first production achieved in 2024. The project has now transitioned to operational status, positioning itself as a significant player in the uranium sector.

BOE acquired the Honeymoon Uranium Project in South Australia in 2015, originally launched as an in-situ recovery uranium mine in 2011. Since then, Boss Energy has utilized the existing high-quality infrastructure on-site and undertaken construction and development work, with first production achieved in 2024. The project has now transitioned to operational status, positioning itself as a significant player in the uranium sector.

Our engagement with Boss Energy has been extensive, evolving from initial financial modelling for early studies to comprehensive support throughout construction and operations. We have developed and maintained a dynamic financial model that equips senior management with essential insights for informed decision-making. Our work has included analyzing and structuring optimal offtake contracts and evaluating funding options to maximize shareholder value. Additionally, we continue to support the project through budget optimization, ASX reporting, and other critical financial functions, contributing to the project’s ongoing success

CASE STUDY

Kimberley Mineral Sands

- (ASX: KMS)

- Western Australia, Australia

- Mining I Mineral Sands

- KMS is a joint venture between Sheffield Resources Ltd and YGH Australia Investment Pty Ltd, is developing the Thunderbird Mineral Sands Project in Western Australia. This project is one of the world’s most valuable zircon deposits, featuring high-grade minerals such as zircon, ilmenite, leucoxene, and rutile. The project development cost of A$500m has been financed through a combination of debt and equity, with significant contributions from Orion Mine Finance and the Northern Australia Infrastructure Fund (NAIF).

KMS is a joint venture between Sheffield Resources Ltd and YGH Australia Investment Pty Ltd, is developing the Thunderbird Mineral Sands Project in Western Australia. This project is one of the world’s most valuable zircon deposits, featuring high-grade minerals such as zircon, ilmenite, leucoxene, and rutile. The project development cost of A$500m has been financed through a combination of debt and equity, with significant contributions from Orion Mine Finance and the Northern Australia Infrastructure Fund (NAIF).

Infinity has played a crucial role in the project’s success, offering extensive analytical and financial support from the early stages to full operations. We have developed and maintained a dynamic financial model, providing KMS senior management with vital decision-making insights. Our economic optimization efforts have involved in-depth analysis and scenario modelling, enhancing the project’s economic performance. Additionally, working with multiple advisors we have facilitated seamless debt structuring and compliance, ensuring efficient funding processes. Our budget management expertise has guided KMS through both the construction and operational phases, helping maintain financial stability and effective resource allocation.

CASE STUDY

Prospect Resources

- (ASX: PSC)

- Zimbabwe, Africa

- Mining | Lithium

- PSC is an Australian-based exploration and development company focussed on opportunities in battery and electrification metals across sub-Saharan Africa. Infinity worked with PSC to develop a Feasibility model for their Arcadia Lithium project in Zimbabwe which was used the optimise the economic outcomes of the project. This model was key to the negotiation and subsequently sale of the asset to Zhejiang Huayou Cobalt in April 2022 for US$378 million in cash. Infinity continues to work with PSC on other opportunities within its portfolio.

PSC is an Australian-based exploration and development company focussed on opportunities in battery and electrification metals across sub-Saharan Africa.

Infinity worked with PSC to develop a Feasibility model for their Arcadia Lithium project in Zimbabwe which was used the optimise the economic outcomes of the project. This model was key to the negotiation and subsequently sale of the asset to Zhejiang Huayou Cobalt in April 2022 for US$378 million in cash.

Infinity continues to work with PSC on other opportunities within its portfolio.

CASE STUDY

Boss Energy

- (ASX: BOE)

- South Australia, Australia

- Mining | Uranium

- BOE acquired the Honeymoon Uranium Project in South Australia in 2015, originally launched as an in-situ recovery uranium mine in 2011. Since then, Boss Energy has utilized the existing high-quality infrastructure on-site and undertaken construction and development work, with first production achieved in 2024. The project has now transitioned to operational status, positioning itself as a significant player in the uranium sector.

BOE acquired the Honeymoon Uranium Project in South Australia in 2015, originally launched as an in-situ recovery uranium mine in 2011. Since then, Boss Energy has utilized the existing high-quality infrastructure on-site and undertaken construction and development work, with first production achieved in 2024. The project has now transitioned to operational status, positioning itself as a significant player in the uranium sector.

Our engagement with Boss Energy has been extensive, evolving from initial financial modelling for early studies to comprehensive support throughout construction and operations. We have developed and maintained a dynamic financial model that equips senior management with essential insights for informed decision-making. Our work has included analyzing and structuring optimal offtake contracts and evaluating funding options to maximize shareholder value. Additionally, we continue to support the project through budget optimization, ASX reporting, and other critical financial functions, contributing to the project’s ongoing success

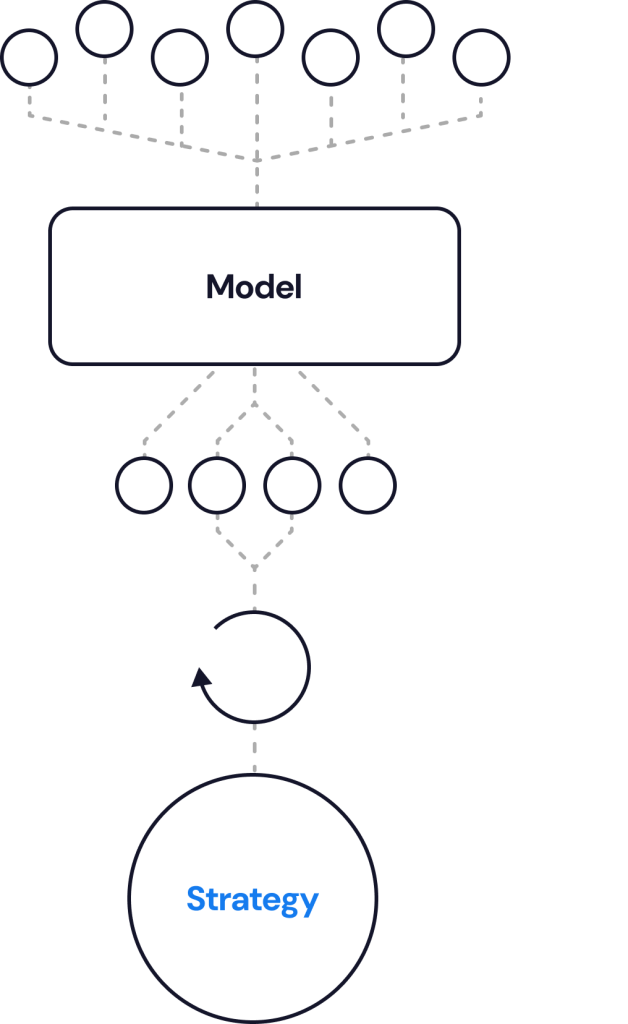

OUR APPROACH

Strategic Financial Consultants

Financial models are at the core of what we do but it’s our experience, insight and ability to help stakeholders understand their business drivers and impacts on value that empowers them to make critical business decisions.

Whether you’re at in the funding, development or operation stage, our financial models and strategic analysis can help you understand, manage and optimise the performance of your project.

Our process will discover the value maximising pathway for your business and will deliver best value for shareholders.

Input & Assumption Audit

With a wealth of hands-on industry experience our directors have a detailed understanding of the technical and commercial issues impacting your business. We have experience across all extractive industries including oil and gas, base, bulk & precious metals, as well as critical minerals – both in developed and developing jurisdictions.

Custom Financial Modelling

Wherever you’re at in the funding and development process, our financial models and strategic analysis can help you understand, manage and optimise the performance of your project.

Scenario Modelling & Analysis

By evaluating a range of potential outcomes by flexing value drivers specific to your project helps you to better understand the inherent risks and opportunities.

Optimisation

Understanding the value impacts of key drivers allows for more informed decision making such as risk management, strategic planning, and resource allocation.

Business Strategy

Your financial model is a powerful tool that adds significant value to business strategy by providing a clear, data-driven framework for decision making. Insights from the model allows you to evaluate the financial impact of strategic options and forecast future performance. Your model will continue to evolve as your business does to ensure your strategic direction is always optimised.

An invaluable part of the Boss Energy growth story

Infinity have supported us from early feasibility studies and have continued to support our growth by integrating our forecast models with actuals, budgeting processes, funding solutions, sales contracting and a range of ad hoc commercial analysis. They always produce high quality work on the first attempt and make the time to accommodate urgent requests. Infinity is always pleasant and easy to deal with and do whatever they can to support us.

- Justin Laird

- CFO, Boss Energy

Infinity’s modelling, analysis and insights provided clarity and high confidence for the CMX Board

Infinity provided ChemX with comprehensive modelling for both of our High Purity Alumina (HPA) and High Purity Manganese (HPM) projects, covering all physical aspects from feed material to the high purity endpoint. Infinity was adept at providing customisable project time horizons, handling variable input assumptions, and ensuring built-in flexibility to model multiple output scenarios and their sensitivities. With the Infinity team’s depth in technical and financial backgrounds, as well as their breadth of experience, it was often the case that the plausibility of a given scenario meant that the Infinity team had already envisioned this within the functionality. When the question was asked, the answer was promptly and intuitively presented.

- Peter Lee

- Chief Executive Officer, ChemX Materials Limited

Infinity is a reliable, flexible, professional, and committed Partner

Infinity provides exceptional support throughout the economic modelling process, bringing significant value and expertise from their extensive experience. Their expertise and reliability freed up valuable internal resources, making a significant impact on our efficiency. Their understanding of the requirements meant they knew exactly what the customer was looking for, ensuring the highest quality of work is delivered.

Turnaround times are consistently excellent, with models often delivered much faster than initially indicated. Their flexibility and ease to work with made the process smooth and efficient, especially given our need to work across multiple time zones which is critical for our project’s success and delivering on schedule.

- Brenton McWhirter

- Study Manager, Fortuna Silver Mines

Infinity’s insights were extremely useful which helped shape the final outcomes we required

Infinity always worked diligently and professionally to develop detailed financial models inclusive of not your typical third-party financing assumptions. Their knowledge extends well beyond financial modelling, as the team understand the mining value chain and can interpret physical assumptions and metrics for best use within a financial model. Infinity seems to have ‘infinite’ capacity, being able to work under tight deadlines and are well versed at setting expectations when it comes to building complex models. They have been a great asset for our business.

- Mark Di Silvio

- CFO & Company Secretary, Sheffield Resources Limited

Infinity integrated seamlessly into the owner’s team and always delivered within project timelines

I am always impressed with the depth to which Infinity understand the drivers of project value and requirements of lender groups and their due diligence consultants. Additionally, the way they structure their analysis goes beyond a static economic view of the project, equipping the technical and financial teams a robust and flexible tool to investigate the interactions between technical aspects, such as mine scheduling, operating costs and deferred capital with economic returns and project financing.

- Stewart Watkins

- Director | Principal Project Consultant, Dhamana Consulting

An invaluable part of the Boss Energy growth story

Infinity have supported us from early feasibility studies and have continued to support our growth by integrating our forecast models with actuals, budgeting processes, funding solutions, sales contracting and a range of ad hoc commercial analysis. They always produce high quality work on the first attempt and make the time to accommodate urgent requests. Infinity is always pleasant and easy to deal with and do whatever they can to support us.

- Justin Laird

- CFO, Boss Energy

Infinity’s modelling, analysis and insights provided clarity and high confidence for the CMX Board

Infinity provided ChemX with comprehensive modelling for both of our High Purity Alumina (HPA) and High Purity Manganese (HPM) projects, covering all physical aspects from feed material to the high purity endpoint. Infinity was adept at providing customisable project time horizons, handling variable input assumptions, and ensuring built-in flexibility to model multiple output scenarios and their sensitivities. With the Infinity team’s depth in technical and financial backgrounds, as well as their breadth of experience, it was often the case that the plausibility of a given scenario meant that the Infinity team had already envisioned this within the functionality. When the question was asked, the answer was promptly and intuitively presented.

- Peter Lee

- Chief Executive Officer, ChemX Materials Limited

Our

Industries

We assist our clients to accurately identify and effectively pursue investment opportunities with robust economics and the highest degree of technical integrity. Our approach is designed to be versatile and can be applied successfully across any industry, while we also bring deep expertise and experience in key industries.

01

02

03

FAQS

Common Questions: Everything You Need to Know

A financial model can be thought of as a digital or “virtual” representation of your business simulating how various factors impact revenue, cost and overall performance over time. A model is key to understanding the value drivers of your business and how changes in these factors impact your profitability, cashflows and valuation. By adjusting the variables in the model you are able to predict and manage risks while uncovering opportunities for growth and improvement.

Moreover, if you are seeking investment or financing, or even plan to sell your business , having a well-built financial model is essential. It provides potential investors or lenders with a clear understanding of your funding requirement, repayment capacity and timing of cashflows, as well as valuation of your business. A robust financial model presented early in any transaction process can capture stakeholders’ interest, instil confidence, and make your business case more compelling and credible.

Businesses require financial models at various stages through their development. In the early stages, a model built with high-level assumptions (low accuracy) can help to formulate strategic direction and screening opportunities.

Once an opportunity is identified and further work is done, the modelling becomes more detailed and incorporates outputs from engineering firms and market consultants such that the accuracy of the inputs and reliability of outputs increases.

By the time your business is ready to seek external funding for construction or expansion, or if you are already an operating company, you will require a detailed and well managed model to meet the requirements of all stakeholders and management.

Engaging Infinity early allows us to develop a financial model with a forward-thinking approach. Our approach ensures that the initial model is designed to expand seamlessly as the study progresses, eliminating the need for multiple model rebuilds. This efficient process saves time and resources, providing a consistent and adaptable foundation throughout each stage of development.

The key elements which comprise inputs for a model are typically:

- Quantities or physicals such as tonnes mined or produced, input or production amounts etc

- Prices of inputs and products as well as details of sales contracts or arrangements

- Operating costs linked to either time (fixed costs) or to production levels (variable costs)

- Capital costs which are typically expenses incurred to either construct or expand operations

- Others such as tax rates, depreciation and other statutory costs such as royalties, duties etc

Infinity can either replace or supplement your internal finance team, depending on the size and skills mix within your organisation. When working for business owners we typically form part of the “owners team” but we may also collaborate with other service providers such as financial advisors/investors, engineering firms & financiers.

Infinity is led by two dedicated Directors who personally manage every aspect of our work. We do not offshore, subcontract or outsource any work, ensuring full control over quality and personalised service our clients deserve. It is important to consider this when considering our pricing and service quality against others. Despite being in business for several years, we have intentionally remained a specialised, boutique firm to deliver service tailored to each client’s unique needs Our focused approach sets us apart in both quality and reliability.

- Experienced Professional: At Infinity, you will always be working with experienced professionals who will listen to your needs and also do the work, rather than having the heavy lifting done by inexperienced juniors or offshore resources with only supervision by senior staff

- Specialised skills without Full-Time Commitment: If you have a need for specialised skills that do not require a full-time role within your company, Infinity can provide you with the necessary support

- Supplementing Your Internal Team: If your internal team is at capacity and requires some additional support to deal with short term increases in workload, we are here to help

- Cost-Effective Alternative to big firms: We are an excellent alternative to larger firms providing similar services but with greater agility and at a significantly more cost competitive

- Continuity Through the Project Lifecyle: Infinity provides long-term continuity of support through the project life cycle minimising the need for multiple costly model rebuilds when changing engineering consultants or financial advisors